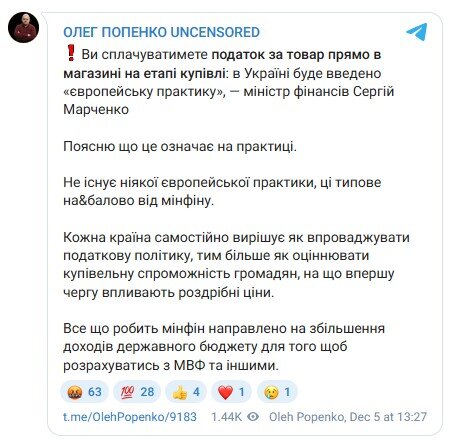

Oleh Popenko, an expert in the housing and utilities sector, has criticized the statement by Finance Minister Serhiy Marchenko regarding the introduction of a “European practice” of paying taxes directly in stores at the point of purchase.

Popenko shared his view on social media on December 5.

According to the expert, there is no single “European practice”—each country independently determines its tax policy and methods for assessing citizens’ purchasing power, which is primarily influenced by retail prices.

“There is no European practice, this is typical bullshit [a deliberate deception] from the Ministry of Finance,” Popenko wrote.

The expert believes that all actions by the Ministry of Finance are aimed at increasing state budget revenues to settle accounts with the IMF and other creditors.

The Ministry of Finance's statements on new taxation approaches fit into the broader context of the IMF's fiscal requirements. The opening of a new four-year financing program for Ukraine, worth over $8 billion, depends on fulfilling a number of conditions. These include taxing income from online operations and eliminating a series of exemptions regarding VAT payer registration. The IMF expects Ukraine to expand its tax base and step up the fight against the shadow economy.

As far back as May, MP Nina Yuzhanina warned that the authorities were actively discussing the taxation of money transfers to bank cards and income from the sale of used goods via internet platforms. According to her, the main focus in these discussions is on the income of private individuals, rather than on structural sources for filling the budget.

At the same time, the tax burden on entrepreneurs has already increased since the beginning of 2025: for Group 1 sole proprietors (FOPs), the total amount of mandatory payments nearly tripled due to the introduction of mandatory Single Social Contribution (ESV) and the military levy. These changes come amid Ukraine's need for external financing projected by the IMF to be over $136 billion in the 2026–2029 period.